From the IRS ruling there seems to be a lot of information floating around about the first time home buyers tax credit. Here is a link to the IRS ruling so you can be sure to be getting the correct information.

From the IRS ruling there seems to be a lot of information floating around about the first time home buyers tax credit. Here is a link to the IRS ruling so you can be sure to be getting the correct information.

The highlights of this ruling are as follows…

If you are a first time home buyer, defined that you have not owned your own home in the past three years, then you could qualify for the tax credit.

You must go under contract before April 30,2010 which will give buyers ample time to shop, negotiate, and purchase their new home. You also must close on the property by June 30, 2010.

Straight from the Horse’s Mouth

Here is a video from the IRS about the Tax Credit

IRS on the New Homebuyer Credit – November 2009

There is another part to this

If you have owned your present home for the past 5 years you are eligible for a $6,500 tax credit if you purchase a new home. You must also go under contract by April 30, 2010 and close by June 30, 2010.

Note that it doesn’t stipulate that you have to sell the old home, but rather vacate it.

If you have questions this is the place to check out, it has the best questions and answers I have seen:

www.realtor.org: government_affairs_tax_credit_FAQs

How do I get the tax credit once I qualify?

You will need to do three things to claim the credit on your 2009 tax return:

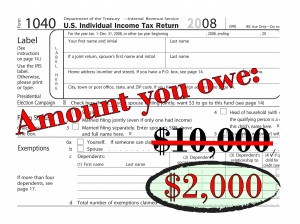

- Fill out IRS Form 5405 to determine the amount of your available credit

- Apply the credit when you file your 2009 tax return or file an amended return (use form f1040x for amending your return)

- Attach documentation of purchase to your return or amended return

Here is a link to different scenarios that the IRS has played out to help you understand your situation.

I think you mean 2010 for the dates listed in this blog. 🙂 It sometimes takes me a few months to be in the right year. But thanks for the great info!!