Every person who thinks about buying a house by borrowing money is wondering what their credit score actually is and how much it will affect their interest rates.

Dan Coffey lecturing

I was at a great seminar yesterday that explained many of the recent changes in the lending world. For most loan programs (including Boat loans) rates are now tied directly to your credit score. Honestly this was a bit of a shock to me, because I assumed they always were.

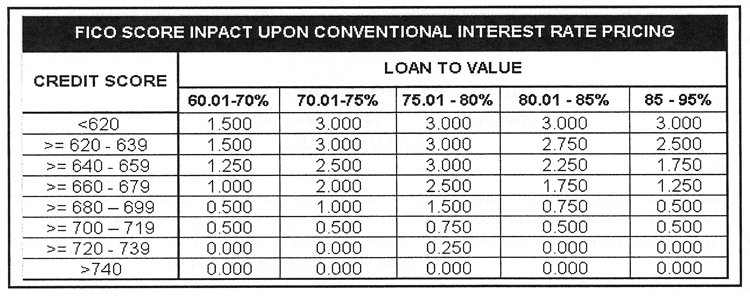

The interest rate you are charged is based on a few things, but two of which are your credit score and the amount of your own money you are investing in the property you’re buying.

If you have a FICO credit score of 740 or higher you won’t see any increase in your interest rate, but other than that your rate increases depending on your score and the amount you are putting down on the purchase.

Here is a chart handed out at the seminar showing how interest rates are affected. Loan to Value is the ratio of the loan amount to the appraised value of the property – (loan amount divided by value).

Mortgage Insurance

It’s interesting to see on this chart that the increase in interest rates peak at the 75% to 80% column and then drop as the LTV increases to 95%. There is actually a logical reason! If you borrow more than 80% of the home’s value you have to get mortgage insurance. The insurance company pays the lender in case you default – that extra risk would have been a higher interest rate for you but instead you are paying for insurance from a seperate company.

Want more about your credit?

Here is a great resource for information on credit and loans:

http://www.myfico.com/crediteducation/articles/

Thanks to Dan Coffey from Countrywide Home Loans for sharing so much valuable information yesterday!