We are working with several first-time home buyers right now. They all have different reasons for wanting to buy a home, but we keep hearing the same things about why they want to move.

Your Neighbor’s Nightly Party

Neighbor’s Party

Are you tired? Maybe that’s because your neighbors are up partying until 3am…

Way back when you didn’t have to be at work by 8:30am every day you liked living in a fun and active apartment complex. That has a special meaning as the Fall semester begins in Gainesville, FL.

Now that you have to get up in the mornings the neighbor’s parties are a nuisance and you have turned your living room couch into a bed to avoid the noise coming through your bedroom window.

Money

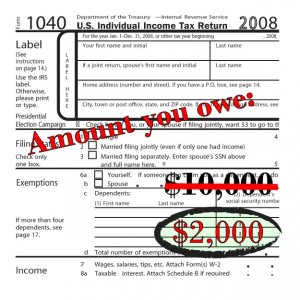

You may qualify for the $8,000 tax credit. Remember, you must complete your purchase by November 30th, 2009 to qualify for the $8,000 credit. There is a lot of information online about the credit, but the best person to ask is your mortgage broker.

This is a tax CREDIT. It is like the IRS is pretending that you paid them $8,000 already – unlike deductions (such as mortgage interest) that are subtracted from gross income before tax is calculated. If qualified for $8,000, you get $8,000, even if you didn’t owe that much in taxes!

– by Kathleen Seide

You can file right away and “amend” you 2008 tax return or you can wait and request the credit with your 2009 taxes.

Interest rates are still low, and that means it is so much less expensive to borrow money now that it has been in a long time. That means you can shave $100 or more off your monthly payment just because interest is cheaper!

Value

Well, there probably hasn’t been a better time for years for first time home buyers to purchase their home than today. With recent price changes you can afford a lot more home now than just 3 years ago. That means you can buy a house instead of a condo, or get a condo instead of being priced right out of the market!

In 2007 $200,000 would buy you a 1,500 square foot 3 bedroom 2 bath home in Alachua County.

You money goes further now

Today the same money will get you a lot more space – so far in 2009 $200,000 would buy a 1,740 square foot home!

- Right now there are 151 homes for sale in Gainesville asking between $180,000 and $220,000. The “average” home is 1,700 square feet and has been listed for almost 4 months.

- There are another 111 homes for sale between $150,000 and $180,000. On average less than $170,000 will get you a 1,400 square feet 3 bedroom 2 bath home built in 1981.

The clock has been turned back – and prices are back to where they were in 2004/2005! It’s kind of like having a time machine.

Getting Started

If you are thinking about taking the plunge but still aren’t sure you can start by taking a couple easy steps.

- Put together a budget so you know how much you can afford to pay each month.

- Talk to a lender to see what that monthly payment will buy you (make sure they include taxes & insurance)

- Look at your bank account – do you have money for a down payment (3.5% minimum) and closing costs ?

- Are there homes in your area that you like available for what you can afford?

- Read more: 6 Steps: Get Your Finances Ready to Buy a House

If you don’t know where to start, get a REALTOR to help. Find someone you can trust who will put your interests first. Then follow their instructions and enjoy the ride. I hope you will enjoy the peace and quiet of your new home.

Bonnie and Kathleen,

You are spot on to see that there are great values in the Alachua County housing market that we haven’t seen in quite a while. I would urge anyone shopping for new homes to take time to educate themselves and ask builders tough questions regarding construction and quality. Real value is a combination of price today as well as durability and performance in the future. Another good idea is to meet the people that will be handling any questions or issues that arise after closing.