The biggest change we are seeing is general slow down in the real estate market by 20% – 30%. People have been staying home and out of public, and only those who need to move have been purchasing property.

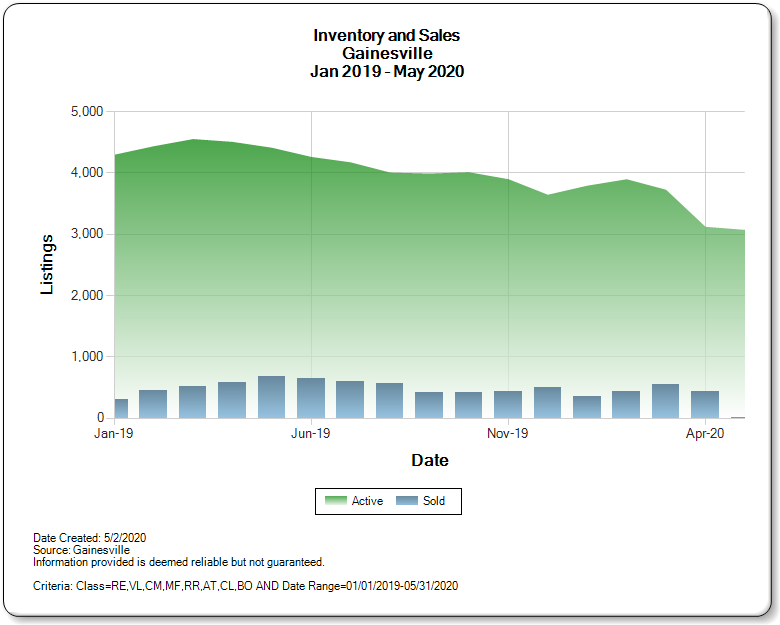

At first glance, there is an obvious slow down in the Alachua market on both the listing and the selling sides. It looks like listings are down more than sales so there shouldn’t be an additional back up of inventory.

| Total Listed | Change Prior Month | Change Prior Month | Change Prior Year | Change Prior Year | ||

| 2020 | January | 931 | 34 | 4% | ||

| 2020 | February | 951 | 20 | 2% | 85 | 10% |

| 2020 | March | 924 | -27 | -3% | -66 | -7% |

| 2020 | April | 641 | -283 | -31% | -322 | -33% |

| Num Sold | Change Prior Month | Change Prior Month | Change Prior Year | Change Prior Year | ||

| 2020 | January | 351 | 41 | 13% | ||

| 2020 | February | 439 | 88 | 25% | -12 | -3% |

| 2020 | March | 549 | 110 | 25% | 39 | 8% |

| 2020 | April | 433 | -116 | -21% | -154 | -26% |

However, it looks like there was ALREADY a glut of inventory in the area. Comparing closings to active listings – it looks like there has been an 8+ month supply of inventory. That is a buyer’s market, going into this recession.

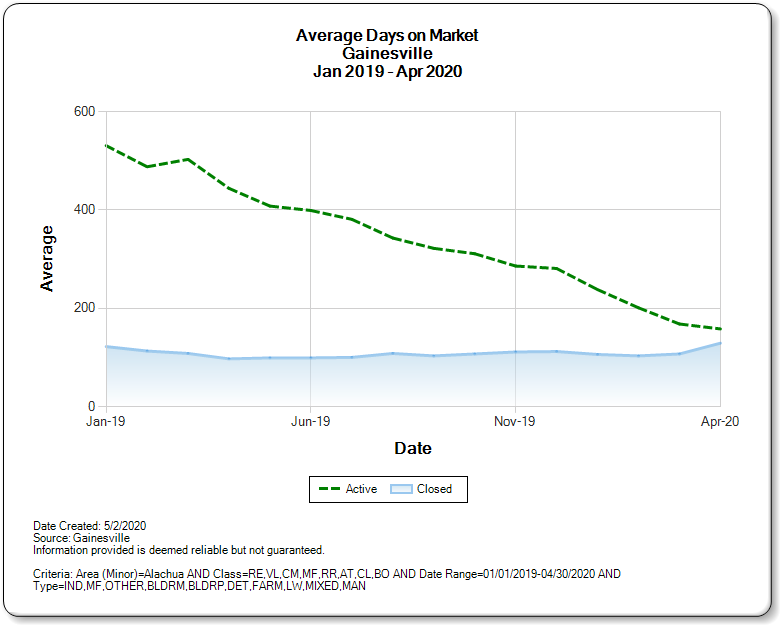

That information is backed up by the DOM information as well. It looks like most properties that sell were on the market for 6 months before closing. And plenty just sit on the market not selling – with an average DOM for active properties that’s been above 200DOM for a while and recently came down.