I just refinanced my home. I recommend that you look into it too.

Interest rates are astoundingly low. Like really really low.

My new rate is more than 1% below what it was before, and if I pay the same monthly payment for my new 30 year loan it will be paid off in about 17 years.

Yeah, that’s a big deal.

That’s all you really need to know – go talk to your banker and get a quote. Or contact me and I will send you 2 or 3 wonderful lenders to talk to.

Now, if you are nerdy like me you want proof. And statistics. And charts.

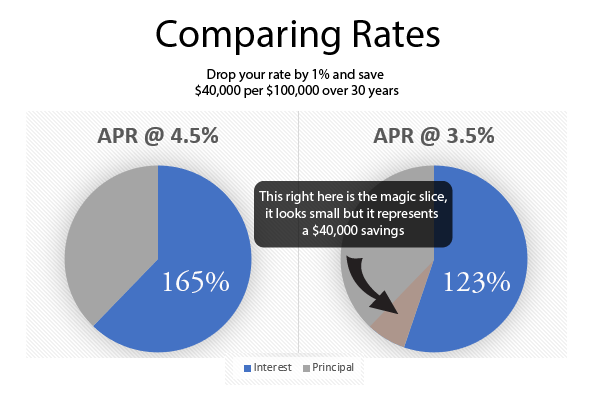

Let’s break it down with a $100,000 loan, so that you can adapt these numbers to fit your situation pretty easily.

Dropping your interest rate by 1% affects the interest you pay over the (30 year) lifetime of your loan… your total interest paid drops by about $40,000.

| Principal | Interest | |

| APR @ 4.5% | $ 100,000 | $ 164,811 |

| APR @ 3.5% | $ 100,000 | $ 123,313 |

| Difference | $ 41,498 |